Brian Matthey

BROWSE

PARTNERSGot a HELOC? Your Mortgage Options Are About to Shrink

11/7/2018

Got a HELOC? Your Mortgage Options Are About to Shrink

By The Spy on November 6, 2018

For more than  a year we’ve speculated that new rules will be adopted, making it tougher to qualify for a HELOC.

a year we’ve speculated that new rules will be adopted, making it tougher to qualify for a HELOC.

How could they not? The Bank of Canada, OSFI, CMHC and FCAC have all been warning about HELOC risk for months. And when multiple government agencies target a financial product, change is a’comin.

And now it’s here.

Banks are tightening rules significantly for those with a HELOC who are applying for a new mortgage (and not closing their existing HELOC).

But this time, it’s not a well-publicized government rule. It’s happening behind the scenes.

How people get approved today

Let’s assume you’re applying for a new mortgage on a second home, cottage or rental property.

Also assume you have a HELOC with a $200,000 limit.

Today, most lenders will make you prove you can afford the payment on the money you owe in that HELOC. If your HELOC has a zero balance, it’s of little consequence to your mortgage application.

If you do owe money in your HELOC, most lenders calculate your assumed payment based on:

- the HELOC balance owing

- the lender’s posted fixed rate (commonly the 5-year posted rate, or 5.34% today), and

- a 25-year amortization.

Here’s what’s changing

Take the exact same scenario as above, but now assume the lender makes you prove you can afford a payment based on your HELOC credit limit.

Even though you might have a zero balance, the bank assumes you might use all of your available credit. It therefore adds a hypothetical $1,334 a month payment to the debts on your mortgage application.

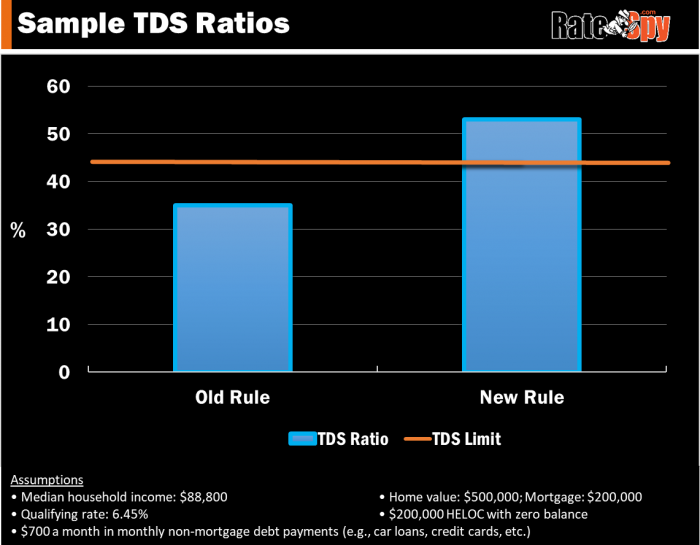

As this chart depicts, the impact is momentous:

This policy change would (will) push tens of thousands of borrowers over the maximum allowable debt-ratio limit, preventing them from getting the mortgage they seek (unless they make adjustments; see below).

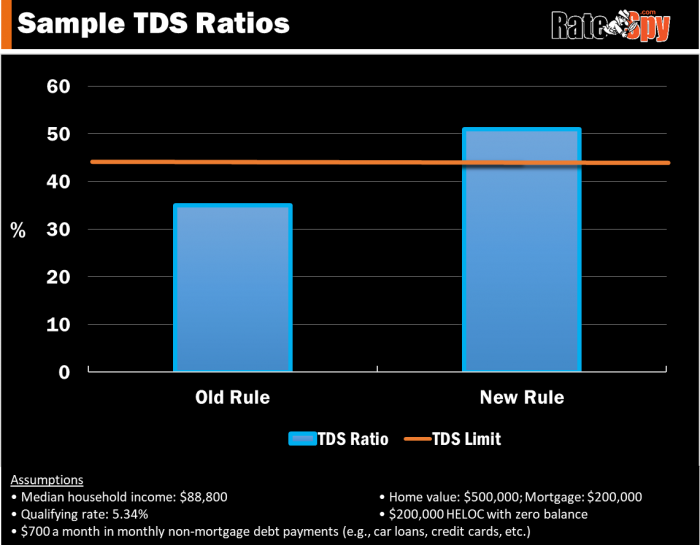

The above example is based on the $200,000 HELOC limit, a 25-year amortization and a stricter 6.45% qualifying rate for illustration purposes, given higher rates could eventually apply. Today, the most common rate lenders use to qualify existing HELOCs is 5.34%, much higher than the best HELOC rates. Using 5.34%, lenders would apply a $1,202 theoretical payment to the borrower’s mortgage application. That results in a still-offside 51% TDS ratio. Here’s how the chart looks with that assumption (still a huge impact on borrowers):

Why it matters

Roughly 3.1 million Canadians have HELOCs, according to CMHC. The number of people impacted will be a meaningful minority of that number.

Given the median homeowner household makes about $7,400 a month, adding a $1,334-a-month payment—almost 20% of gross income—to their debts (for mortgage qualification purposes) is big potatoes!

Take a typical borrower with an “average” total debt service (TDS) ratio of 35%, for example. If that person wishes to retain his or her $200,000 HELOC (whether they use it or not), suddenly their TDS ratio soars to over 50%.

The result: they no longer qualify for additional financing. (Note: 44% is the maximum TDS limit for prime HELOCs, but 40% or 42% is more common.)

This rule update is market-moving. And intuitively, its purpose sort of makes sense. But don’t be fooled, says broker Shawn Stillman of Sigma Mortgage. “It’s just chipping away further at borrowers’ options.”

Who’s doing it

So far, three of the six largest banks have moved to this debt-ratio calculation method.

Canada’s undisputed leader in HELOCs (TD Canada Trust) just made the change November 5.

TD explained its logic in this email to RateSpy:

The Debt Service Ratio change was made to ensure prudent underwriting guidelines, and reflects concerns around consumers’ abilities to manage debt – particularly in a fluctuating rate environment.

Before this change, a borrower’s capacity to service their entire authorized limit was not assessed, even though the borrower had access to those funds. This change helps ensure our customers make informed financial decisions by assessing their affordability on the available lines of credit they currently hold in addition to any credit they apply for.

…The change aligns with our existing prudent underwriting guidelines, with the impact being limited to a small number of customers that have an existing home equity line of credit and are applying for additional financing.

RBC, Canada’s second-biggest HELOC lender, is using a similar method. Earlier today, it told us:

RBC reviews every mortgage based on a number of factors, including a client’s credit worthiness and history, and their ability to repay. When evaluating an applicant’s capacity to repay we need to understand their total financial picture. We are unable to see if a HELOC from another financial institution is secured or unsecured, so we assess the client on the assumption that they could draw on the available credit at any time rather than assuming the balance at the time of application will remain unchanged…

Who’s behind all this

“This came from somebody in the government,” Stillman says. “Banks never would have had a eureka moment and said, ‘We need to do this from a risk point of view.’ It’s not justified with delinquencies of 25 basis points.”

And here’s some more relevant stats: Homeowners with a HELOC (and no mortgage) have 81% equity on average, according to data from Mortgage Professionals Canada. The number of standalone HELOC holders who borrow more than 50% of their equity is just 7%.

Broker Ron Butler of Butler Mortgage agrees. “Let’s face it, TD is the biggest HELOC provider in Canada. Chances are, OSFI is trying to put a lid on [HELOC growth] because, factually, rates are guaranteed to rise 50 bps at least, 100 bps at worst, in 12 months. For a government who has a hard time not interfering in anything, it’s tough to leave that one alone.”

Indeed, this issue has been on policy-makers’ radars for a while.

A senior banker we spoke with yesterday, who didn’t want to be named for obvious reasons, told us that OSFI inspired this policy.

We asked OSFI to confirm that and the banking regulator told us:

When underwriting a new HELOC application, as per B-20 principles, OSFI expects federally regulated financial institutions (FRFIs) to ensure the borrower has the ability to expect full repayment over time, which means the Gross Debt Service Ratio (GDSR) for a HELOC application should be calculated based on the HELOC limit requested.

When underwriting any loan application where the borrower has an existing HELOC in place, FRFIs may use either the limit, or outstanding balance of the HELOC, to estimate an ‘assumed payment’ in calculating the Total Debt Service Ratio (TDSR) for this loan application. It is at their discretion, however OSFI expects that, given the revolving nature of a HELOC facility, FRFIs will take a longer term (and conservative) view of the borrower’s debt servicing requirements.

Borrower workarounds

If:

- you want a mortgage

- you have a HELOC that you want to keep

- your prospective lender stress tests you based on your HELOC limit

- you have higher-than-average debt ratios

…then here are some of your options:

- Find another lender

- As mentioned, only a handful of lenders use this policy now, but as Stillman notes, “This industry is all monkey see, monkey do.” Given OSFI’s priorities, we expect most big banks, if not all, to apply it by year-end, or next year at the latest.

- Many non-federally regulated lenders who get their funding from banks should also follow suit.

- Expect lenders who don’t apply this debt-ratio policy to charge higher rates for this “service” (just as credit unions do for borrowers who don’t pass the federal stress test).

- Lower your HELOC limit

- Banks that stress test you on your HELOC limit will try hard to retain your new mortgage business. Two ways they’ll do that is by recommending you:

- convert your HELOC debt to an amortizing fixed or variable-rate mortgage.

- lower your HELOC limit(s) so you qualify for new financing.

- Banks that stress test you on your HELOC limit will try hard to retain your new mortgage business. Two ways they’ll do that is by recommending you:

- Close your HELOC

- A minority of affected borrowers may choose to close their HELOCs altogether.

- Others may trade them in for an unsecured credit line (which are typically qualified based on 3% of the balance, at least for now).

- Get a co-borrower.

Who wins

- The economy, say policy-makers

- They argue that it’s economically beneficial because less risky HELOC borrowing (and accounting for what borrowers might borrow) makes the economy more stable.

- That’s apparently notwithstanding the fact that HELOC arrears are less than mortgage arrears and near an all-time low. Nor does it account for the economic and jobs benefit of greater HELOC liquidity (which has never been OSFI’s guiding consideration).

- Lenders that can convince existing borrowers to lock in HELOC debt to fixed rates (assuming those fixed rates are more profitable for the lender) and stay with them.

- Mortgage brokers—because they have lender solutions banks don’t—and they know which lenders aren’tapplying the new policy.

Who loses

- Consumers

- HELOCs have countless prudent uses. Restricting them further reduces economic opportunities for investors and cuts fallback liquidity for Canadians who rely on HELOCs to weather economic shocks.

- Mortgage brokers (yes, they win and lose)

- If you say to a borrower, “You don’t qualify for a mortgage because of your HELOC,” the first thing they’ll do is go to their bank” and ask how to fix it, says Stillman.

- The bank will tell the borrower they’ll work with them to get them approved if they get their mortgage through the bank. And a good chunk of these borrowers will then stay with their bank.

Looking to the Future

The higher rates go, the harder it’ll become to qualify for a HELOC and/or a mortgage if you already have a HELOC.

“In a rising rate environment, at what point does it not make sense to add two points on the stress test anymore?” Stillman asks. If we get three more hikes, as the markets predict, the qualifying (“stress test”) rate on HELOCs could exceed 7%. Coupled with stricter debt-service policies, HELOC growth would collapse in this scenario. (Regulators’ end-game?)

“It’s going to hurt the upper end of the market, people with higher priced properties that have big HELOCs,” Stillman predicts. This will further slow real estate given many of those people rely on HELOCs to buy rental properties, cottages or second homes.

With every new lending rule comes higher costs for prudent consumers and increased risk for borrowers who gravitate to more costly (higher risk) lenders. This one will be no different.

Rightly or wrongly, there’s an obsession in Ottawa with borrower risk. It makes you wonder how far they’ll go to stamp it all out. Next thing you know, lenders will be asked to assign a hypothetical payment to people’s credit card limits. (We say that only half jokingly.)