Tess Velkovska

BROWSE

PARTNERSHow Does Mortgage Qualifying Work?

11/16/2018

How Does Mortgage Qualifying Work?

Have you ever wondered what lenders look at when deciding to approve a mortgage application or not?

If so, you are not alone!

When talking to local real estate agent, Katie Kertesz, she mentioned that it is common for her clients to be concerned about their approval and that the process can be intimidating. Most mortgage agents do not take the time to educate their client on the application process, they simply just fill the blanks in on the application form. This can leave you wondering what the odds are, and what determines the outcome. I try my best to educate my clients so that there are limited surprises and that they fully understand the application process.

For those of you I have not met with I hope this blog will give you some insight.

There are four main areas of interest to Canadian lenders

The Big 4 – Income, Credit, Down Payment, and Property

1. Income

Lenders need to know how you will be able to make your mortgage payments. They like to see steady guaranteed income that can be proven. If you work for a company, typically lenders will ask for a recent pay stub and a letter of employment to confirm your income. It is also very common for them to call your employer to confirm your employment details.

If you are self employed, or heavily rely on commission/overtime, the lenders will require your last two years of income filed on your taxes. Other documents will be needed as well depending on your type of business.

Lenders also calculate your total and gross debt servicing ratios. Total debt service ratio (commonly referred to as TDS) is calculated by adding up all of your monthly debt obligations (credit cards, lines of credits, auto payments, loans), and your housing expenses (property tax, heating, condo fee, mortgage payment) and dividing that total by your gross income. Gross debt service ratio (commonly referred to as GDS) is only your housing expenses (property tax, heating, condo fee, and mortgage) vs. your gross income. Each lender will have a maximum TDS and GDS in their lending guidelines that you must fit into in order to be approved. I go over these ratios with my clients.

2. Credit

I always tell my clients to think of their credit bureau as a report card. Your credit bureau reports all of your outstanding debts, and credit that is available to you. It shows if you make your payments on time and if you extend yourself financially. Lenders want to know that you are likely to make your payments to them on time and they will look at your credit bureau as your track record.

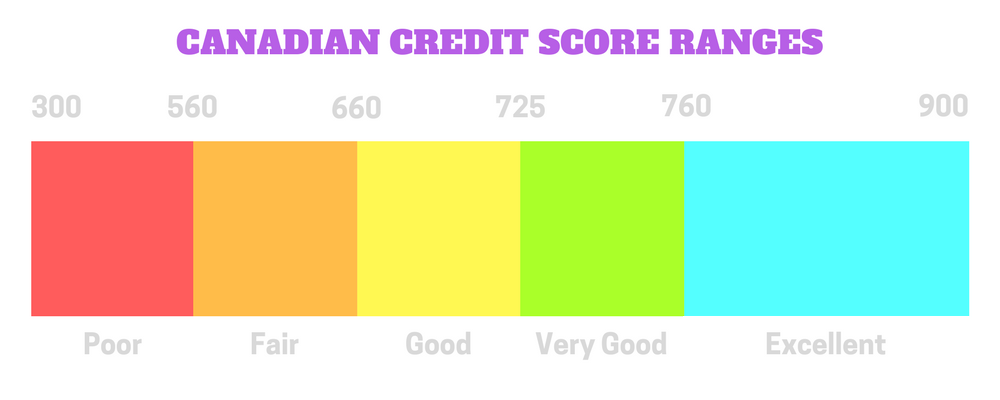

Each lender has different credit guidelines but generally lenders want a 700+ credit score with no recent late payments. I do have access to subprime lenders as well that consider clients with lower credit scores.

3. Down Payment

A down payment is needed in order to purchase a property.

Lenders require that there is equity in the property for their security. It is possible to put as little as 5% down on a personal residence which is very common for first time home buyers. If you put less than 20% down it is mandated by the government that you pay CMHC insurance. This is an insurance premium that protects the lender if you were not able to make your payments. This premium gets added to your total mortgage amount and is not paid up front. You only have to pay the hst on the premium amount up front at the time of closing. Since it is added to your total mortgage amount it makes a minimal difference on your monthly payment. The premium varies depending on the purchase price and how much you are putting as a down payment.

If you have access to 20% or more down than you can forgo the insurance premium charge. Required down payment varies depending on your personal application.

Lenders will want a 90 day history of your down payment if coming from your own personal funds. You can also have down payment gifted to you by an immediate family member. Regular banks and lenders do not allow you to use borrowed funds as your down payment.

4. Property

The lender wants to make sure the property you are purchasing is easily resalable. They may ask for an appraisal on the property to confirm the property value and to ensure it is in good resalable condition. An appraisal is not always required, but it is more commonly required when you put 20% or more down since the lender will not be covered by CMHC insurance. The appraisal not only protects the lender but it protects you as well.

The above information is intended as a general guideline. If you want to know how much of a mortgage you qualify for and what documentation is needed the best way to find this out is to contact me directly. Every application is different, and each lender has different guidelines so it is not always black and white.

Once we have talked mortgages I highly recommend that you get in touch with Katie. She has a wealth of real estate knowledge and she is driven to make sure her clients get the home they want at the price they want!

Tess Arpa Katie Kertesz

Mortgage Agent , Excel Mortgage Real Estate Agent , Remax